kentucky lottery tax calculator

Please note the amounts shown are very close approximations to the amount a jackpot annuity winner would receive from the. When it comes to paying taxes your gambling income is treated the same way as wages or salary.

Calculators Blog Archives Taxact Blog

Kentucky has a 6 statewide sales tax rate but also has 211 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top.

. Income tax withheld by the US government including income from lottery prize money. Lottery winnings are considered ordinary taxable income for both federal and state tax purposes. Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 4000000 and.

Where the Money Goes KY Lottery. The tax rate is the same no matter what filing status you use. Heres a breakdown of how the money is distributed for each and every dollar we receive.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. For several people gambling can mean regularly betting on sports to buying the occasional lottery ticket. India used to tax 309 plus additional income tax.

That rate ranks slightly below the national average. This is actually a favorable change toward the previous policy. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the state you live in the state you bought the ticket in and a few other factors.

Kentucky imposes a flat income tax of 5. Buy a Lottery ticket now. For example lets say you elected to receive your lottery winnings in the form of annuity.

Lottery Winning Taxes for India. The tax rate is the same no matter what filing status you use. For most counties and cities in the Bluegrass State this is a percentage of taxpayers.

A federal tax is levied on all winners of prizes greater than 5000 while many of the participating states apply their own tax on top of this. This varies across states and can range from 0 to more than 8. Your tax bracket may also go up when winning a large amount.

The table below shows the payout schedule for a jackpot of 268000000 for a ticket purchased in Kentucky including taxes withheld. The taxes you will have to pay in order to receive. Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 4000000 and.

Lottery tax calculator takes 6. At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 750. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

This can range from 24 to 37 of your winnings. After a few seconds you will be provided with a full breakdown of the tax you are paying. The tax rate is five 5 percent and allows itemized deductions and certain income reducing deductions as defined in KRS 141019.

51 rows The State Tax Calculator. Lottery Payout Calculator is a tool for calculating lump sum payout and. Our tax calculator can be accessed and used free in any state and is great to use in the more popular gambling states like NJ NV MI PA IN and CO.

Also check out our Powerball Payout and Tax Calculator to figure out how much taxes you will owe on your lottery winnings and also your payout for both cash and annuity options. The latest changes to the lottery law imply that you will have to pay 28 on all winnings. Additional tax withheld dependent on the state.

The statistics indicate that India has one of the harshest taxes in the world. The Pulaski County man made the drive to lottery headquarters later that day walking away with a check for 1236820 after taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The Kentucky Department of Revenue is responsible for publishing the. He chose to take the lump sum cash payment of 1742000. The money you spend on each and every Kentucky Lottery game you play goes many different places including to the funding of Kentucky college scholarships.

To use our Kentucky Salary Tax. In addition some locations such as New York City levy a local tax on lottery winnings. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state.

It means that whether you choose the lump sum or annuity option your lottery winnings are listed under income tax and you need to report them on your tax returnIn the United States winners are subject to paying federal and state taxes on. This varies across states and can range from 0 to more than 8. A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the.

That means your winnings are taxed the same as your wages or salary. Overview of Kentucky Taxes. Calculate your lottery lump sum or annuity payout using an online lottery payout calculator or manually calculate it yourself at home.

You can find out how much tax you might have to pay below. And you must report the entire amount you receive each year on your tax return. Overview of Kentucky Taxes.

Other Lottery Calculators and Tools. Kentucky imposes a 6 percent tax rate on all lottery winningsThat may not sound like a lot but it adds up very quickly. Kentuckys individual income tax law is based on the Internal Revenue Code in effect as of December 31 2018.

Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. Kentucky has a flat income tax of 5. Im a single dad so I can really use the money Turner said.

Recently the Mega Millions hit a whopping 1 billion If you held the winning ticket for that drawing you would have paid 60 million right off the top to the state of Kentucky alone. Weve created this calculator to help you out with lottery taxes. The Kentucky State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Kentucky State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

The taxes that are taken into account in the calculation consist of your Federal Tax Kentucky State Tax Social Security and Medicare costs that you will be paying when earning 4000000.

Calculators Blog Archives Taxact Blog

The 1 Source For Lottery Results Reviews And News

Calculators Blog Archives Taxact Blog

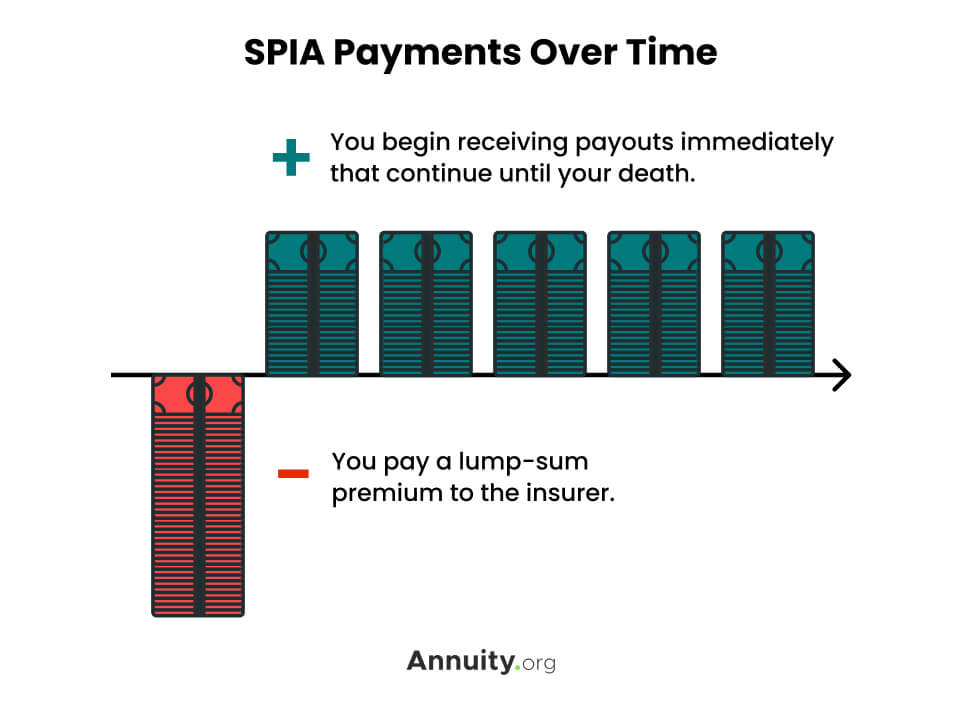

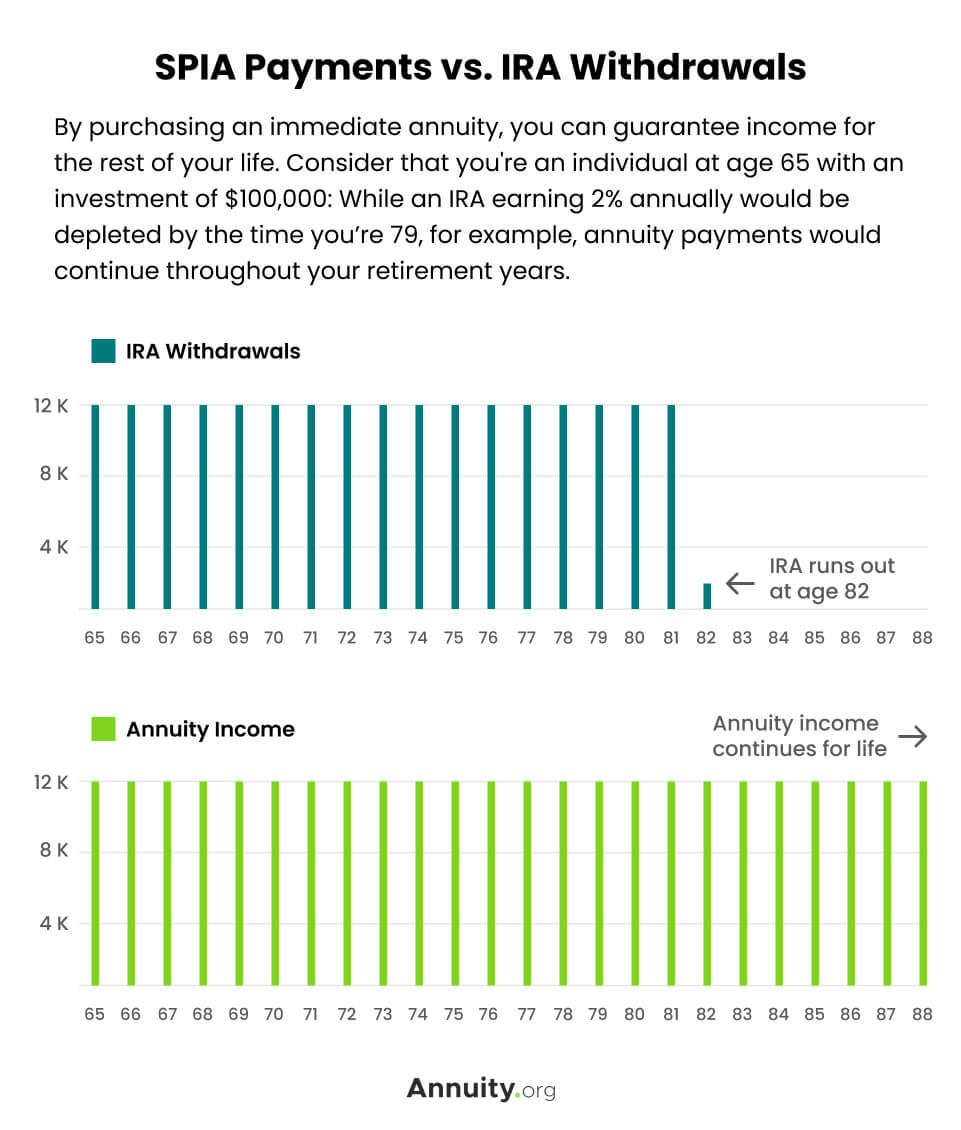

Single Premium Immediate Annuity Spia Rates Pros Cons

Calculators Blog Archives Taxact Blog

Anserini Topics Mq 10001 20000 Txt At Master Castorini Anserini Github

Calculatrice De Taxe De Loterie Mise A Jour 2022 Lottery N Go

The 1 Source For Lottery Results Reviews And News

2 Million Powerball Winner Claims Ticket Remains Anonymous Local News Paducahsun Com

Calculators Blog Archives Taxact Blog

The 1 Source For Lottery Results Reviews And News

Only The Best Online Lottery Sites Of 2022 Tested And Verified

Single Premium Immediate Annuity Spia Rates Pros Cons

Single Premium Immediate Annuity Spia Rates Pros Cons

Single Premium Immediate Annuity Spia Rates Pros Cons

Calculators Blog Archives Taxact Blog

2 Million Powerball Winner Claims Ticket Remains Anonymous Local News Paducahsun Com